Woodworker Business Insurance - Choosing The Right Policies

Woodworkers are both technical and artistic. To transform pieces of wood into cabinets, chairs, doors, and everything in between requires geometry, creativity, and an eye for detail. What’s unique about woodworking is that this artistry involves some risk—cutting, carving, sanding, and assembling is all in a day’s work.

Like other tradespeople, having the right insurance is crucial for safeguarding woodworkers from the inherent risks of the job. Even the most skilled professionals make mistakes that could damage client property or cause injuries. But what type of woodworker business insurance is best and why? Are there challenges woodworkers face in getting quality coverage? We’ll answer all that and more.

Get A Quote For Your Woodworking Business

Get a quote online to see your best options for insurance! Available in most states.

Why You Need Insurance For Your Woodworking Business

Professionals in all industries wonder if it’s worth it to purchase insurance, or if they should take the gamble and hope that nothing will happen to trigger a claim. If this question is crossing your mind, it’s important to know that the cost of claims is increasing, and won’t be cooling off anytime soon. Bearing the financial brunt of a claim could be overwhelming. Also, in some cases, the choice to get coverage is yours; in other cases, it’s not. In short, woodworkers do need insurance. Here are the main reasons why:

Financial Protection

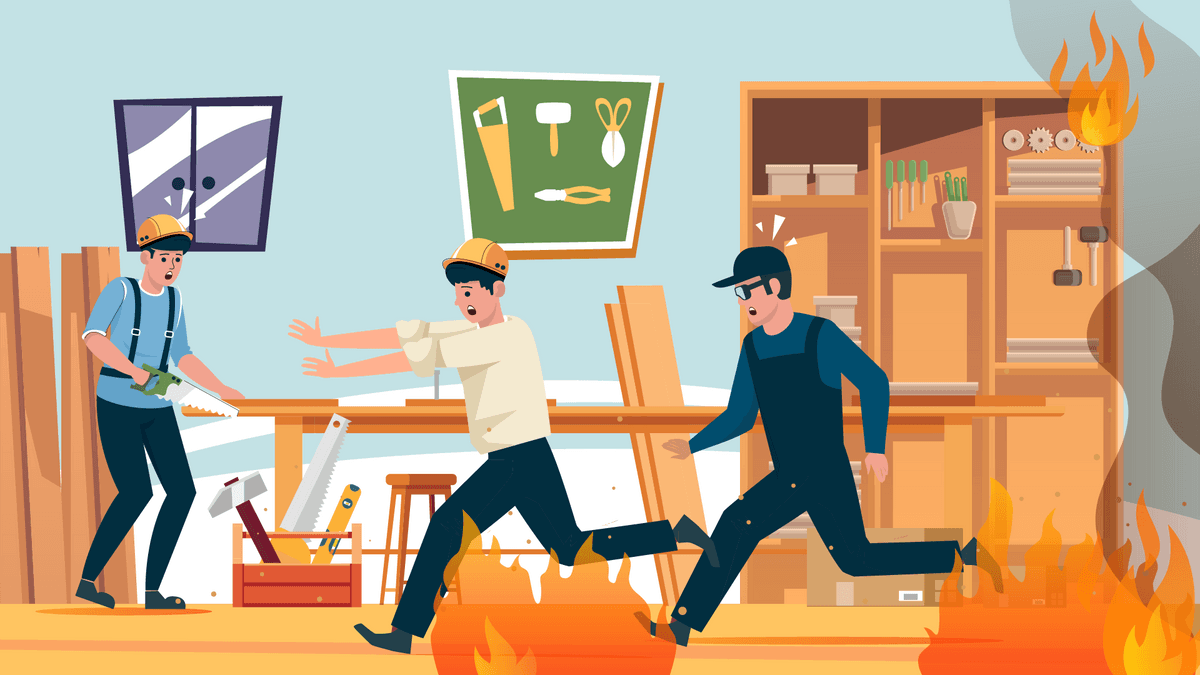

Woodworkers use powerful, expensive tools. They also spend their days on job sites or in workshops that are full of hazardous and flammable materials. It costs a lot of money to replace tools that have been damaged or stolen, deal with the fallout of a workshop fire, or rectify a project gone awry. Woodworking insurance will cover your losses from these situations so they won’t impact your business’s finances.

Contractual Requirements

Some clients may require that you carry general liability insurance before they allow you to bid on a project. Additionally, if you need to secure a bank loan, oftentimes the bank will require that you carry property insurance to cover the property that they have listed as collateral for your business.

Client Trust

Having comprehensive coverage assures clients that any damages or issues arising from your woodworking projects will be addressed without major disputes or financial implications for them.

Types of Woodworker Business Insurance You Need

It’s confusing to sort out which policies protect you from different risks. There is sometimes a bit of coverage overlap between policies, but typically each type of insurance is designed to protect you from “gap” that might threaten your business. These are the five most essential woodworking insurance coverages to have:

General Liability Insurance

General liablity (GL) is the most common and broadest policy—nearly every business needs this policy. GL covers costs related to injuries or property damage. For example, if a visitor trips in your workshop and breaks an arm, this insurance would cover their medical expenses.

Product Liability Insurance

This is an extremely important insurance for woodworkers because you typically build “high-touch” products that people interact with frequently. In other words, your products get used a lot, which means there is more of a chance of them breaking. Product liability protects against claims of injuries or damages caused by products after they are completed and leave your shop.

While products liability insurance is usually included in a general liability policy, this coverage has to be purchased separately for businesses that produce high-hazard products—and woodworkers often fall within that category.

Property Insurance

For woodworkers who run their business out of a commercial location, property insurance covers damages to the building. For example, if a fire broke out in the shop or a natural disaster damaged the structure, the claim would be covered. This type of policy not only protects the building itself, but the contents of the building (e.g. furniture, fixtures, machinery, etc.) and the personal property of others within the building.

Inland Marine Insurance

It’s a bit of a misnomer, but “inland marine” refers to goods and equipment that are transported across land (whereas “marine” insurance refers to transport over water). This policy covers property that you own, such as tools and equipment or even finished items, while they are in transit or off the workshop premises. If they are stolen or damaged (let’s say, by falling off a truck bed), you’re covered.

Business Interruption Insurance

When the worst happens—a fire, tornado, or even hurricane—and your business has no choice but to shut down so it can recover, business interruption insurance keeps you financially afloat. This policy pays for lost income and employee salaries when your woodworking business has to halt operations due to a covered event.

Workers Comp Insurance

In woodworking, the use of heavy machinery and sharp tools presents inherent risks to employees. Workers’ Compensation Insurance helps cover medical expenses and lost wages for employees who are injured on the job. It also protects your business from potential lawsuits related to workplace injuries.

Woodworkers Insurance Claims Scenarios

To help explain the important of insurance for woodworking businesses, let’s look at examples of how different claims might play out:

- Defective Products: A customer alleges that a wooden chair you built and sold to him broke under normal use, leading to a back injury. Product liability insurance would help cover the costs related to this claim.

- Workshop Damage: A storm rips off part of your workshop’s roof and damages the machinery. Property insurance would cover the roof and machinery repairs.

- Tool Theft: Some of your expensive tools get stolen from a job site and vehicle. Inland marine insurance will cover the replacement costs.

- On-Premises Accident: A visitor to the workshop gets injured by tripping over equipment. General liability would handle the claim.

Insurance Challenges For Woodworkers

Again, woodworkers have specialized talents and their daily projects come with risks that other tradespeople may not face. This means a woodworker’s skills are very valuable, but also makes insurance companies nervous. Here are some of the reasons why you may face some red tape when looking for comprehensive woodworking insurance at a good price:

Fire Hazards

Insurance companies are always worried about fires. Because every woodworker’s shop is full of saw dust and small pieces of wood, it increases the risk of a fire not only starting easily, but then quickly raging out of control. Showing the insurance company that you have good dust collection systems and cleanup procedures will go a long way in lowering your cost of insurance.

Workers Compensation

The nature of the job—working with saws, hammers, drills, and breathing in potentially hazardous dust—will be a concern for insurance providers. There are quite a few options out there for workers compensation coverage, but to get the best rate, have quality safety procedures in place to mitigate some of the most common injuries.

Products Liability

Not all, but many woodworkers make products that could potentially hurt the user. Over the years, LandesBlosch has underwritten furniture manufacturers, playground manufacturers, and even woodworkers who made furniture for children. Since the insurance company is on the hook if your product injures a customer, they want to know that your products are safe. If you make a high-risk product, you can give the insurance company some confidence by demonstrating your risk management strategies, such as QA, product testing, and warning labels.

The Bottom Line

It’s important to understand the different types of insurance for woodworkers and choose the right policies for your business. Not all policies are created equal and coverage with too many gaps can threaten the long-term stability of your operations.

There’s no doubt, woodworkers have a unique job and it can exhausting to sort through all your insurance options. But it is possible to find the balance between comprehensive coverage and affordability. We can help you do that. Contact us for a free quote and get advice on how to best protect your woodworking business.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.