What Is Excess Insurance?

·

6 minute read

The majority of business liability insurance policies come with liability limits of $1,000,000 per occurrence - but is this enough?

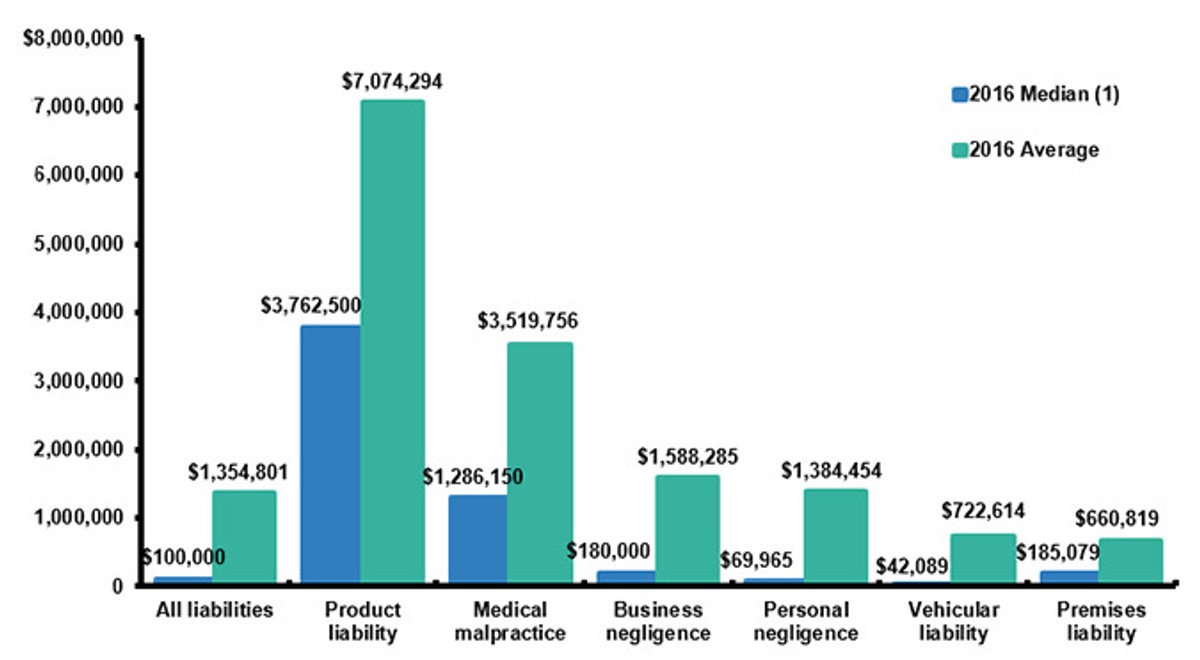

The statistics say NO! Below are the average and median verdict amounts for business lawsuits.

$1,000,000 is not enough coverage for a business when the average business negligence lawsuit is $1.5 million, and the average product liability lawsuit is $7,000,000+.

There is a way to cover yourself and your business, though.. excess limits of liability.

Need Higher Liability Limits?

We've got you covered! Excess liability quote options from multiple insurance companies.

What is Excess Insurance?

An excess insurance policy is an insurance contract purchased in addition to a primary insurance policy. This excess policy covers any claim or expense payment above the primary insurance limits. Although different for each coverage, excess insurance is generally available for most property & casualty exposures.

Types of Excess Insurance

Excess insurance policies are generally "follow-form". This means that the policy does not create any new coverages - it merely extends the exact terms of your primary insurance policies.

Insurance Layers Explained

Frequently, the limits your organization need to be acquired from multiple policies and / or other providers. When you do this, it's called "layering insurance".

Insurance layers are a combination of primary and excess insurance policies stacked to create a limit larger than a single insurance carrier can (or would want to) offer.

For example:

Let's say the above graph represents the coverages for a construction company that constructs roads and bridges. To work on a large government project, the company needs a liability limit of no less than $9,000,000.

The problem is that no single carrier will offer an excess policy larger than $3,000,000 over the primary liability policy. Does this mean the contractor cannot get adequate limits?

No! It means the contractor has to purchase an additional excess policy to reach $9,000,000.

Examples of why your organization needs excess insurance

Construction

Your company was hired to construct a deck for a large home. The project is complete, and the customer was pleased with how the deck turned out at the time.

When the homeowner was entertaining guests, and everyone went out on the deck, it collapsed. The guests fell off the balcony from over 15 feet, severely injuring six people and resulting in one fatality.

The jury awards the injured parties a total of $8,000,000 to pay for medical bills and other damages.

The primary insurance paid $1,000,000, and an $10,000,000 excess liability policy covered the rest.

Manufacturing

Your business designs and manufactures ladders that can be purchased online and at various hardware stores.

During the manufacturing process, there is a flaw in the ladder that results in the ladder collapsing while customers are using the ladder.

This defect results in multiple severe injuries.

The jury awards a total of $5,000,000 to the injured parties.

The primary insurance paid $1,000,000, and a $5,000,000 excess liability policy covered the rest.

Real Estate

You own an apartment complex that has 100 units. Some of the units are lofts that have stairs leading up to either the bedroom or a spare room.

While one of your tenants was walking up the stairs, they tripped and fell off the loft resulting in severe and permanent injuries.

The jury awards a total of $2,000,000 to the injured party.

The primary insurance paid $1,000,000, and a $5,000,000 excess liability policy covered the rest.

Churches & Religious Institutions

Your church is hauling 25 of your youth group members to a week-long summer church camp.

On the trip, the bus has a tire blow out causing the bus driver to lose control of the vehicle. The vehicle ends up running off the road and flipping.

There are no deaths, but several severe and permanent injuries.

The jury awards a total of $2,000,000 to the injured parties.

The primary insurance paid $1,000,000, and a $5,000,000 excess liability policy covered the rest.

What Insurance Carriers Write Excess Insurance?

One of the most reliable and most cost-efficient carriers to purchase excess insurance from is your primary liability carrier. Since this carrier underwrites your primary liability, chances are they will write at least some excess limits.

In addition to cost savings, if you ever needed the coverage, it is always better to have one carrier responsible for paying the entire claim.

For small businesses, most primary insurance providers will write a $5 million to $10 million policy for excess coverage. For mid-sized companies, most primary liability carriers can offer $25 million in excess limits. Frequently, anything beyond those limits, insurance carriers will want to limit their exposure and request you find additional limits elsewhere.

Excess Insurance Pricing

The general rule with excess insurance is that with each million in addition to the primary limits that you purchase, the lower each million in limits cost.

For example, if the first million in your general liability program costs $10,000, the second million would cost $6,000, and the third million could cost $4,000.

Why is that? Because the closer your limit is to zero, the more likely it will be used in a claim.

Ask your risk advisor

If your primary insurer is not offering excess limits or limits high enough to protect your business, ask your insurance broker or contact us. There are a lot of options and different strategies for achieving an insurance program with high limits.

Summary

As lawsuit verdict sizes continue to grow, it is essential to protect yourself and your organization from risk. One of the best ways to do that is to purchase an excess casualty insurance policy.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.