Understanding Contractors Errors & Omissions (E&O) Insurance

·

12 minute read

Contractors errors and omissions insurance, also referred to as E&O insurance, protects trade contractors from damages arising out of faulty workmanship, limited design services, recall of their work, or use of defective materials.

If you are a general contractor, design-build contractor, or construction manager, you might be looking for contractors professional indemnity insurance. For more information, check out our insight, "Contractor Indemnity Insurance: Everything You Need To

Know."

Who needs contractors E&O insurance?

Determining whether you need E&O insurance largely depends on the scale of your business, the general contractors you perform work for, and the type of work you perform. However, there are common types of contractors that purchase contractors E&O insurance, according to Victor Insurance Managers:

- Acoustical contractors

- Audio/visual contractors

- Carpentry contractors

- Concrete contractors

- Drywall contractors

- Electrical contractors

- Elevator contractors

- Excavation contractors

- Exhibit contractors

- Fire sprinkler contractors

- Geotechnical contractors

- Fiber optics contractors

- Flooring contractors

- Highway contractors

- Landscape contractors

- Masonry contractors

- Mechanical contractors

- Millwright contractors

- Painting contractors

- Paving contractors

- Pool/spa contractors

- Renewable energy contractors

- Roofing contractors

- Signage contractors

- Soil contractors

- Structural contractors

- Telecommunications contractors

- Utility contractors

- Wastewater/sewer contractors

- Water well drilling contractors

- Window installation contractors

For more information on what types of insurance contractors need and details on when they might need those coverages, visit our insight, "A Guide To Contractor Insurance In 2023."

Need E&O coverage for your business?

Fill out the form below to get your free quote today!

What does contractors E&O cover?

In this article, we are using the CNA (an insurance carrier) contractors E&O insurance policy, which is one of the most popular options for this coverage.

This is a common policy in the construction industry, but they tend to vary by carrier. These E&O insurance policies can even be slightly different for policyholders using the same insurance company, so make sure to read your policy (or have us do it for you) before assuming your policy is the same.

Regardless, most contractors E&O policies include common features.

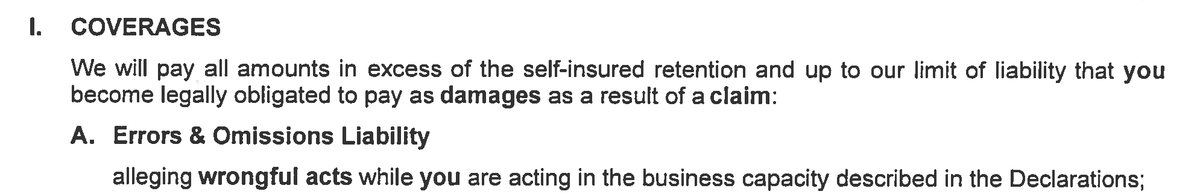

To find out what coverages are included in a contractors E&O policy, get out your insurance policy or quote (or just follow along here). Under the "Insuring agreement," usually on the first page of the policy, there will be a bolded term that the policy covers. Most of the time, this word will be a variation of "Wrongful act." Here is an example:

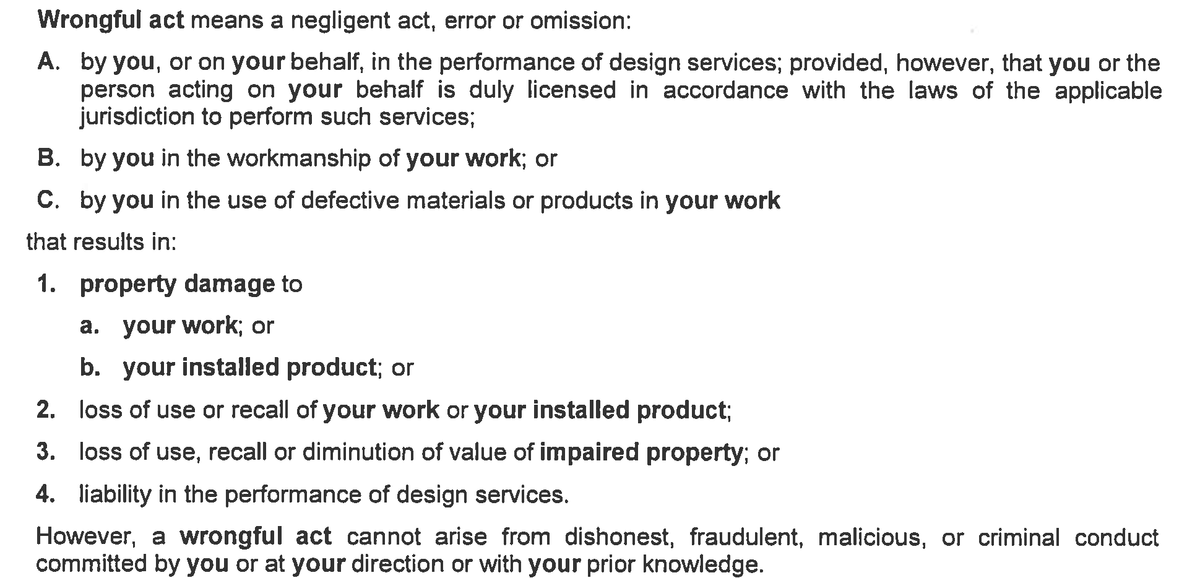

If a word is bold, it means you need to go to the definitions section to determine how the policy defines that word. Let’s go to the "Definitions" section of the policy to review what is covered under the word "Wrongful act." In this policy, it states:

As you can see, points A through C list three distinct coverages. These coverages are errors or omissions in the design work; faulty workmanship; and the use of defective materials or products in your work. The policy then lists what damages it will cover arising from those three claims categories.

But what do these three coverages mean for your business? Here is more information about each of them:

1) Errors Or Omissions In The Design Of Your Work

The first coverage provided on the contractors E&O insurance policy involves defects in the design of your work.

Suppose you provide services that involve not only the installation of a project but also the pre-installation design work. Or maybe you provide recommendations on the sizing of certain products or materials (pipe sizing recommendations, mechanical equipment recommendations, and so on). If that sounds like you, this coverage is applicable to your business.

If it is determined that a design flaw caused the project to not serve its intended purpose for the client, this coverage would help pay for the damages that the design defect caused.

2) Faulty Workmanship

Let’s face it – at some point during your years in business, you have probably made a mistake. Chances are you will probably make one sometime in the future, too.

No matter how much experience you have or how careful you are, mistakes can happen. When the client suffers financially because of your mistake (due to project delays, loss of income, reinstallation costs, etc.), the contractors E&O policy will cover your liabilities arising out of the situation.

It is important to note that if your faulty workmanship causes property damage or bodily injury to the client, that is a general liability claim. The contractors E&O insurance policy is meant to supplement the coverage gaps on the commercial general liability policy.

3) Defective Materials Or Products In Your Work

At times, what looks like faulty workmanship or an issue with the design can actually be defective materials that you purchased from a supplier. These can range from defective concrete to defective products like electrical panels or pool pumps.

If, after the initial incident, it is determined that the installation of defective material or a defective product was the cause for the incident, the contractors E&O policy will respond and pay for damages.

What doesn't contractors E&O cover?

Although the contractors E&O policy covers a variety of things, there are some limitations that you should be aware of. The policy will not cover these incidents:

1) Bidding Inaccuracies

Bidding inaccuracies can have a disastrous impact on your business. If, when bidding on projects, you overlook the specifications or make a mistake that results in underbidding the work (which in turn results in your business taking a loss on a project), the contractors E&O policy will not cover those mistakes.

2) Advising Or Failing To Advise Any Legal Work Or Title Check

There are numerous contracts and agreements associated with building projects. If you provide any legal advice, it is not covered

under this policy. That includes providing advice on a contract. If you have a

client asking about a particular contract or agreement, we suggest referring

them to a licensed attorney in your area before offering up your advice,

because this policy won’t cover any mistakes you make.

3) Pollution

Pollution liability is a concern that many contractors face as they scale up their businesses.

Many insurance companies are beginning to offer a contractors E&O and pollution combination policy. This is primarily due to subcontractors needing both E&O and pollution coverage while working for certain general contractors (explained in more detail in our insight, "A Guide to Contractor Insurance").

Because these combination policies are common, we want to point out that having a contractors E&O does not mean that the policy covers pollution as well. Unless you specifically purchase a policy that has both E&O and pollution coverage, this type of claim will not be covered.

For more information on pollution liability and what it covers, check out our insight, "Contractors Pollution Liability (CPL) - What To Know."

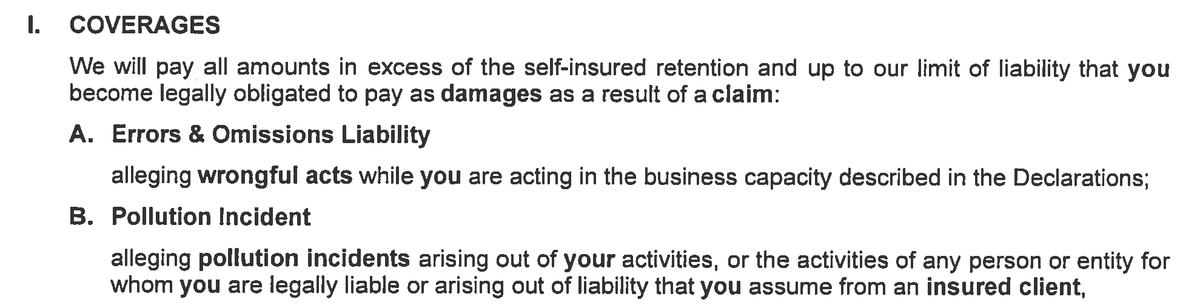

You can figure out whether you have this coverage by looking at the first page of your coverage form and seeing if pollution is included under the coverage section. Additionally, you can always reach out to us and we can help you determine what is covered under your current contractors E&O insurance program.

As you can see, this policy would include both since it covers both "Errors & omissions liability" and "Pollution incident."

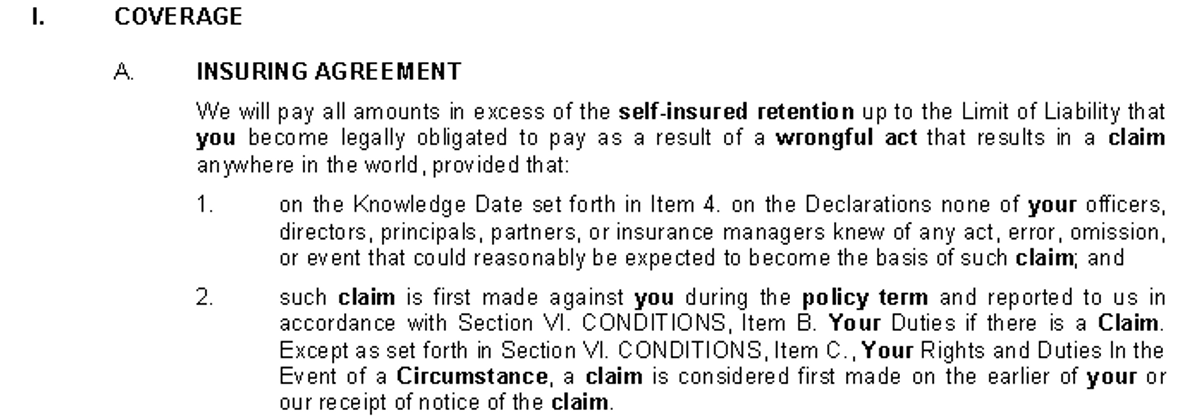

For contrast, here is a coverage policy that does not include pollution coverage:

Fill Your Coverage Gaps Without Busting the Budget

Get a variety of coverage options from a company with 100 years of experience.

Contractors E&O Claims Examples

Let’s assume for a second that you owned an electrical contractor business that serves commercial and industrial clients.

In this particular scenario, you were hired by a building owner to update the electrical system in a manufacturing facility to accommodate their expanding operations, new building layout, and increased power consumption.

This $500,000 project involved removing the old electrical system, recommending the replacement system, designing the replacement system's configuration, and installing the new system.

After the project was installed, the building owner realized that if certain machines were turned on in certain areas of the building, they tripped the breaker. As a result, the business owner could only operate half of the facility. Not only did they have to reinstall the project, but they also lost income while half the facility was non-operational.

Below are contractors errors and omissions examples for each of the three coverage parts in this scenario after an investigation into what happened:

1) The Design Defect Claim

Upon further investigation, it was determined that both the electrical design and the contractor's recommendations were flawed. There was a mistake made in the calculations when putting together the project that resulted in the system being unable to power the entire facility.

Resolution: The contractors E&O policy would respond to the reinstallation and lost income damages under the "Errors or omissions in the design of your work" coverage section.

2) The Defective Materials Claim

Upon further investigation, it was determined that the design and installation were correctly performed. The problem was determined to be a defect in the electrical panel that limited the amount of power that could be supplied to the facility.

Resolution: The contractors E&O policy would respond to the damages that the client suffered as a result of the lost income and re-installation under the "Defective materials or products in your work" coverage section. Although there might still be some contributing responsibility from the supplier or manufacturer, the contractors E&O policy would take care of the claim quickly and sort out the contributions from other companies afterward.

3) The Faulty Workmanship Claim

Upon further investigation, it was determined that although the design was correct, the electrical system's installation was performed improperly. This faulty installation is what ultimately caused the system to have power limitations, resulting in financial damages to the client.

Resolution: The contractors E&O policy would respond to the damages that the client suffered as a result of the lost income and reinstallation under the "Faulty workmanship" coverage section.

Summary

Contractors often purchase contractors errors and omissions coverage to:

- Protect their business against design defect and faulty workmanship lawsuits.

- Pay for damages resulting from installing defective material

- Pay for and coordinate an experienced legal team to help them through a lawsuit

If you need help finding the best contractors errors & omissions insurance policy for your business, or need help understanding your current policy, let us know!

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.