Personal Use Of Company Vehicles: What To Know

Many companies are allowing their employees to drive business vehicles for personal use, whether it’s an owner driving to the store or an employee running an errand.

Although it appears to be harmless, allowing company vehicles to be used for personal use opens up your business to a significant amount of legal risk.

Your business could be on the hook financially and face damage to its reputation is certain actions occur, such as drinking and driving or a severe personal accident.

If this is a practice in your business – even if it is just one instance of allowing employees to use company cars for personal use – we suggest you find out if you have personal use of company vehicle insurance.

We’ll also suggest some changes you can make to your commercial auto insurance policy to better accommodate the risk and ensure you are protected.

Who is the Named Insured?

To have coverage on any insurance policy, you must be a "Named Insured," meaning you are eligible to receive coverage under the insurance program. Naturally, this is the first place we will look when making a coverage determination.

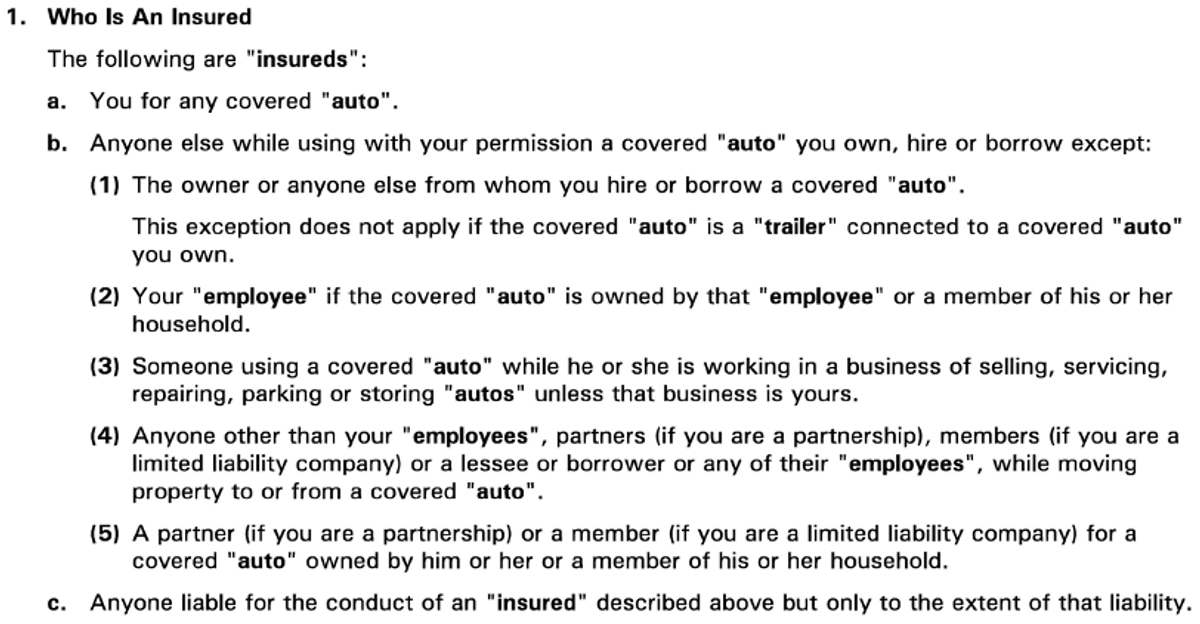

Here is what most commercial auto insurance policies include as the

Named Insured:

Under a commercial auto insurance policy, you have three basic types of Named Insured.

- Named Insured For A Covered Auto

- Permissive User Of A Covered Auto

- Anyone Held Vicariously Liable For An Insured

Since using a company vehicle for personal use is considered permissive use of a vehicle, in this insight, we will focus on #2: "Permissive User of a Covered Auto." Before moving on, please note that not all permissive users of a covered auto are Named Insureds.

You can see that there are five exclusions to the permissive use of a covered auto. If you have an employee driving your company vehicle and are included in one of these exclusions, you might not have coverage for personal use.

Cover Your Employees Whenever They're Behind the Wheel

Get a free quote in 5 minutes.

Important Things To Consider

Now that we have determined whether the employee is a Named Insured, we have to look into the variables that could affect the exposure to risk your employee and your company face while allowing personal use of company cars.

Here are some important questions to ask yourself:

Does the employee have their own auto insurance policy?

Personal auto insurance better covers the risks that individuals face while using a vehicle for personal use, as opposed to a business auto insurance policy, which is better designed to deal with business-related accidents.

Does your employee have other vehicles with personal auto insurance, or are they relying strictly on your commercial auto insurance policy to provide the coverage that they need?

If your employee does not have coverage on another vehicle that they own, we suggest that they purchase furnished car coverage (if available – some insurance companies do not offer this policy). Alternatively, the company can purchase Drive Other Car coverage to add to the commercial auto policy. Below you’ll find additional details on how to correctly add Drive Other Car coverage.

Although Drive Other Car coverage, or DOC, is not as broad as a personal auto policy, it does provide some of the same protections as a personal auto policy, such as the ability to drive cars that they do not own and still be covered for auto liability.

Do you have a personal use of company vehicle policy with a contract in place?

We suggest creating a contract with every employee that uses a company vehicle for personal use that includes accident reporting, driver qualifications, authorized vehicle use and so on.

Having a policy that determines permissive and non-permissive use of the vehicle can be critical in mitigating the risks that your business could be exposed to while the vehicle is not under your control.

Do you have additional excess liability limits to account for the increased risk?

Having employees driving around at all times of the day in conditions that you cannot control creates a significant amount of risk. This could have the unintended consequences of exceeding your liability limits and leaving the business to pay the remainder of the legal judgment.

We suggest purchasing additional limits in addition to your $1,000,000 primary commercial auto liability. The more vehicles you have, the larger your business, and the more employees driving for personal use will determine what limits you should purchase.

This will give you some added cushion in the event of an accident that exceeds $1,000,000.

Have you addressed any privacy concerns associated with GPS monitoring during personal use?

We recommend that commercial fleets use a telematics program to lower their cost of insurance and give them more control over their vehicle fleet. Have you addressed the privacy issues associated with having a GPS on the vehicle and your employee using it for personal use?

We suggest that you include a disclosure that the vehicle does include a GPS tracking device on the company vehicle personal use contract to avoid any invasion of privacy.

Do you have an agreement to resolve any damage during personal use?

Do you have an agreement with your employee regarding how damage to the company vehicle will be resolved if it occurs during personal use? Do you have an agreement regarding who will pay the insurance deductible?

There is a high likelihood of this happening, so we suggest working out something with company car insurance rules to determine who is responsible for each expense.

Will workers compensation pay for injuries during the personal use of a company vehicle?

While workers compensation insurance does cover injuries to employees while on the job, it will not cover injuries that happen outside the scope of work activities.

Will the employee's family be driving the vehicle?

Although employees are covered under the typical business auto policy, their family members and significant others are frequently not.

A personal auto policy that the family members are Named Insureds on can often cover the gap in coverage. You can also add significant others and children to the Drive Other Car endorsements or add them as an individual Named Insured.

Our recommendation is to avoid this situation. On our sample personal use of a company vehicle contract above, you can see that we limited the use of company vehicles only to employees unless authorized or in an emergency medical situation.

Allowing the use of company vehicles by non-employees is a bad idea. You cannot verify their driving history and you cannot provide training, if necessary. If something happens, you can quickly lose control of the situation and expose your company to additional lawsuits from driving accidents.

Endorsements To Consider For Personal Use Of Company Vehicles

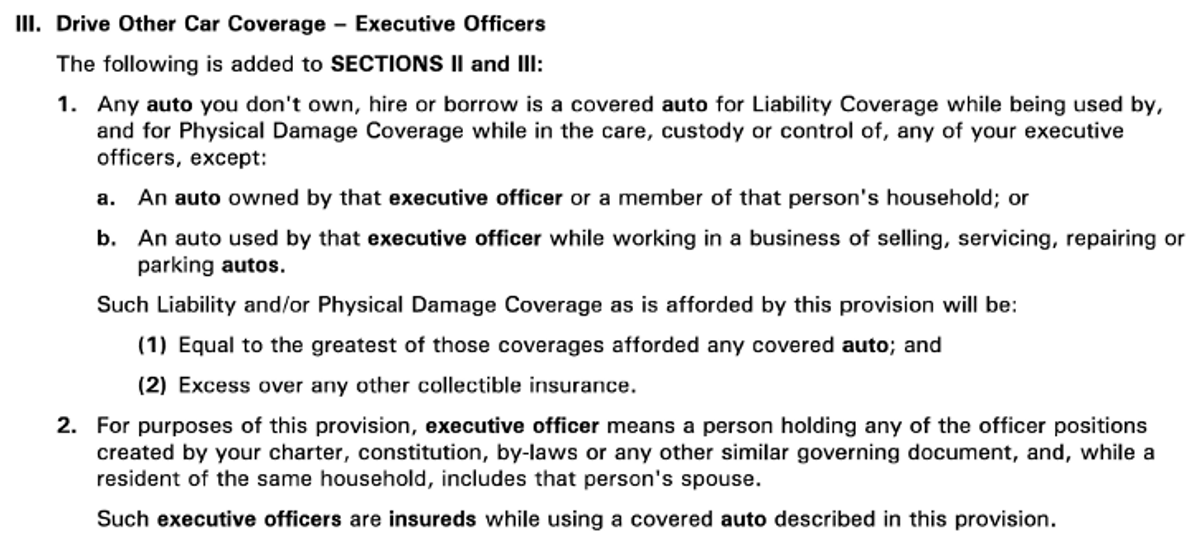

Drive Other Car Coverage (Endorsement CA 99 10 10 13)

Even though the commercial auto liability insurance extends to permissive users of a company-owned vehicle, sometimes owners, executives, and employees might need to rent or borrow a vehicle for personal use – and this is not covered under a commercial auto policy.

This endorsement extends coverage to include the personal use of a non-owned auto, but only to individuals listed on the endorsement.

Additionally, since this is most common with owners and business executives, there can be Drive Other Car coverage included in many "broadening endorsements" that you can purchase for a small addition in premium. These endorsements do not need specific names added if you fit within the definition of the covered individuals.

Here is a common example:

Hired Auto Coverage (Symbol 8 Coverage)

When addressing the topic of personal use of a business vehicle, it is hard to ignore rental cars.

If you have employees that frequently travel for work, they will most likely rent a car and a hotel while out of town. During that time, they will probably complete some personal trips or errands, too.

Is personal use covered in a vehicle rented by the business? Yes, as long as the use is permissive and if "Symbol 8 Hired Auto" is included on the insurance policy.

Summary

Furnishing employee company vehicles that they can use for personal use is a large risk that your business may not want to take. If you choose to do so, however, there are certain coverages and steps you should take to make sure that you are protected.

If you have any questions about your specific situation or personal use of vehicles, schedule a free call to review your operations and get expert advice.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.