E&O Insurance Quotes

·

5 minute read

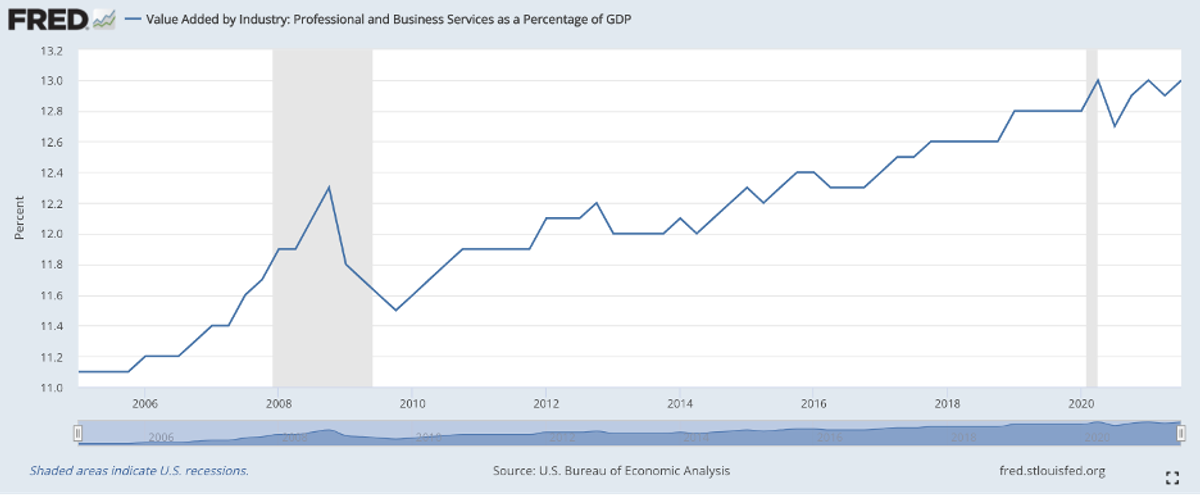

Professional and business services are a huge part of the U.S. economy. This industry accounts for 13% of our GDP and is growing every year.

Source: FRED Economic Data

From an insurance standpoint, professional services are different from other types of businesses because their primary risk isn't causing property damage or bodily injury to others (claims covered by a commercial general liability policy).

Their primary risk is a mistake in their work causing a financial loss to a client.

That is why errors and omissions (E&O) insurance is so important for owners of professional services companies. It protects your business from lawsuits arising from the services or advice you gave that negatively impacted your clients.

Looking For E&O Coverage?

We can help! Schedule a call or start an online quote today.

What businesses need E&O insurance?

E&O insurance is a must-have for businesses that:

Provide Services Or Opinions To Others For A Fee

Offering an opinion, recommendation, or professional service to anyone for a fee.

Assist Clients In Administrative Functions

Making mistakes in the administrative tasks you are hired to complete (such as migrating a database or performing bookkeeping).

Work On Tight Deadlines

Providing services that have strict deadlines which need to be met or there will be a financial penalty for the client (for example, missing a tax filing deadline).

Sign Client Contracts That Require E&O Insurance Coverage

Complying with client requirements that you must have E&O insurance to do business with them. Some businesses even require vendors to maintain their policy for a certain amount of years after the project is completed.

Have Services Integrated In Another Company's Product Offering

Increasing the risk landscape and potential for mistakes that cause the client financial harm by integrating your product or service into another company's product.

Types Of Businesses That Purchase E&O Insurance

Although many different companies need E&O insurance for various reasons, here are the most common types of businesses that purchase this policy:

- Consultancies

- Marketing & PR Firms

- Construction Management Companies

- Law Firms

- Accounting Firms

- Staffing Firms

- Business Process Administrators

- Technology Companies

- Healthcare Companies

- Real Estate Inspectors

- Engineering Firms

- Architecture Firms

- Real Estate Companies

- Property Management Companies

- Insurance Agencies

- And more...

What does E&O insurance cost?

You can expect to pay around $400-600 per year for a standard E&O policy—this is based on a self-employed consultant doing low-risk work. The premium will increase as your business generates more revenue and hires more employees.

If you are involved in high-hazard work, premiums will likely start at $1500 or even $7500, depending on your industry. For example, an aerospace engineering consultant will pay more for insurance than a career coach.

How To Get An E&O Insurance Quote

For a small business errors and omissions insurance quote in a low-risk profession, you can get a quote instantly online.

If you have specialized needs, are in a higher risk profession, run a larger company, or were unable to get a quote online, call us and speak to one of our risk advisors. We can provide a quote usually within one business day.

Whether you choose to quote online or over the phone, we are dedicated to finding you affordable E&O insurance.

E&O Insurance FAQs

What is the difference between professional liability and E&O insurance?

There is no difference between E&O insurance, malpractice insurance, and professional liability insurance. These are just different names for the same type of policy.

Why do insurance companies ask for information about my client contracts when getting an E&O quote?

Having client contracts that include things like limitations of liability, hold harmless agreements, and work approval procedures are some of the best ways to avoid having claims in the first place; and if you do have claims, these inclusions severely limit the amount of money you could be liable for paying.

Since the insurance company is covering your risks, they need to be sure that you have quality contracts in place that reduce your liability.

Are E&O policies different for each profession?

The accounting, legal, and healthcare industries have E&O policies that are unique and use specific industry wording. For the majority of other industries, coverage is written on a "Miscellaneous Professional Liability" policy.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.