Contractor Umbrella Insurance - What To Know

·

7 minute read

Construction and risk go hand in hand. Contractors are often required to lift heavy objects, operate large equipment, and work with high-voltage electricity to help build our homes, buildings, and infrastructures. There is no way to completely avoid these risks.

In construction, accidents happen all the time. In fact, one in five workplace deaths occurs on construction projects, making this one of the most hazardous businesses to be in.

You can protect yourself, though, and minimize the damage an accident can cause to both people and the company’s balance sheet. The best way to do this is to purchase a contractor umbrella insurance policy.

What is contractor umbrella insurance?

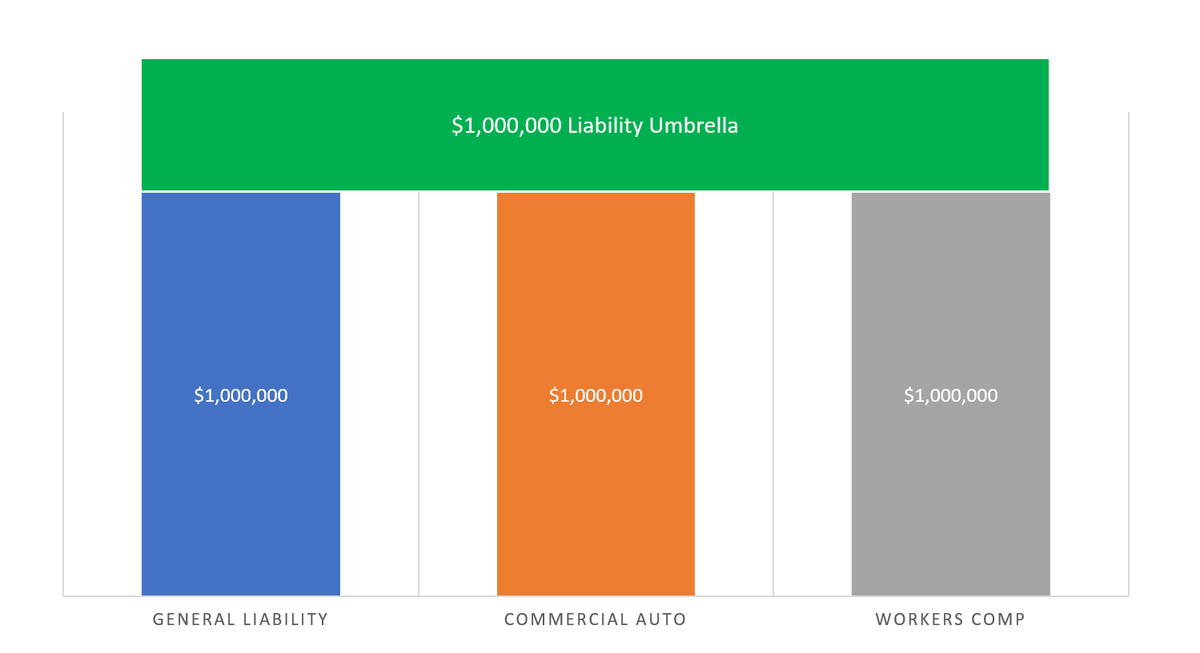

A contractor umbrella insurance policy increases the

limits of your general liability, commercial auto liability, and workers comp

liability limits (employers liability).

For example, if you purchased a standard general liability policy with a limit of $1,000,000 per occurrence as well as an additional $1,000,000 umbrella liability insurance policy, you would now have $2,000,000 in total limits per occurrence.

Ready To Increase Your Limits?

Secure a tailored quote for your business today.

The result is the same when you add additional underlying policies. If you have $1,000,000 general liability and $1,000,000 commercial auto liability limits, and then purchase a $1,000,000 umbrella, your insurance will now cover $2,000,000 for general liability or a commercial auto accident.

This scales up—your umbrella policy can be as large as you’d like. The more risk and assets your business has, the bigger of an umbrella you should purchase. Additionally, since commercial trucks are a significant source of liability claims, we suggest you always have an extensive umbrella policy if you have trucks in your fleet.

2 Commercial Umbrella Insurance Claim Examples

There are countless examples of umbrella insurance claims, but here are a couple that we think can happen to almost any contractor.

Construction Defect Or Faulty Construction

Construction defects are one of the most probable and costly events that can happen to a contractor. It is not uncommon for a finished project to have issues that result in a person's injury.

For example, if you built a deck at an apartment complex that failed while 15 people were standing on it, you would most likely be investigated for faulty work and sued for the resulting injuries (or deaths) involved in the accident.

Since you are in the construction industry, this risk is unavoidable. And the more projects you work on, the more risk accumulates over time. Due to the severity of these claims, many contractors choose to purchase umbrella insurance to help protect themselves.

Auto Accidents

In a previous article, we explained why we thought auto accidents are one of the top 4 risks facing contractors today. With contractors driving larger vehicles and going to projects across the state, it is no wonder why contractor auto accidents are so common.

Not only are medical bills increasing and vehicle repairs getting costlier, but juries are awarding penalties of record-breaking amounts every year for these accidents. Just verdicts that awarded amounts around $500,000 are now $1,000,000, and we are starting to see more nuclear verdicts that reach $30 million, $50 million, and sometimes up to the $100 million range.

How To Get A Contractor Umbrella Quote

When it comes to securing comprehensive liability coverage for your contracting business, obtaining an umbrella policy is a crucial step. However, the process of acquiring this coverage requires careful consideration. Here are the best practices to follow when seeking a contractor umbrella quote:

1. Leverage Your Current General Liability (GL) Agent

If you already have an agent managing your other liability policies (General Liability, Auto, and Workers' Compensation), they should be your first point of contact for an umbrella policy. Here's why:

- Seamless Integration: Your current agent is familiar with your existing coverage and can easily identify gaps that an umbrella policy should address.

- Competitive Rates: They can often secure the umbrella policy with your GL carrier, potentially resulting in better rates.

- Efficiency: Working with your existing agent typically leads to quicker response times and a smoother application process.

2. Consider Consolidating All Liability Lines Under a New Agent

If you're dissatisfied with your current insurance setup or looking for a fresh perspective, consider the following approach:

- Comprehensive Quote: Seek quotes for all your liability lines, including the umbrella policy, from a new agent.

- Holistic Coverage Review: A new agent can provide a fresh look at your entire liability coverage strategy, potentially identifying areas for improvement or cost savings.

- Simplified Management: Consolidating all policies under one agent can streamline your insurance administration and improve overall coverage coordination.

3. Avoid Split Agency Arrangements for Umbrella Policies

Our strongest recommendation is to avoid having one agent handle your umbrella policy while another manages your other liability policies. Here's why this approach can be problematic:

- Coverage Gaps: An agent handling only the umbrella policy may not have full visibility into your underlying coverage, potentially leading to dangerous gaps in protection.

- Coordination Challenges: When policies are split between agents, there's an increased risk of miscommunication or oversight, especially during policy renewals or carrier changes.

- Delayed Claims Processing: In the event of a claim, having multiple agents involved can complicate and delay the claims process.

- Inconsistent Policy Updates: Changes in your business or underlying policies may not be promptly reflected in your umbrella coverage if managed separately.

Remember, your umbrella policy is your last line of defense against catastrophic liability claims. Don't leave its effectiveness to chance by fragmenting your coverage management.

Summary

Your business may not be large enough to need a $99 million umbrella policy, but an umbrella of any size will help avoid potential bankruptcy due to a bad accident. Because the risks contractors take simply by driving commercial vehicles and trucks, contractors umbrella insurance is a critical component to protecting your company.

If you need additional information about coverage options and pricing for umbrella insurance policies, let us know.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.