Commercial Property Insurance: What Are The Average Costs?

·

5 minute read

Determining the cost of commercial property insurance can be extremely complex.

To unravel the complexities of commercial property insurance rates, you first need to have an understanding of how pricing is determined.

The insurance company's goal is to predict the damages most likely occur to a property if they were to insure it. The insurer wants the cost to be as low as possible to gain customers and market share, but also make the industry average of a 2% overall profit.

Looking For Options On Commercial Property Insurance?

Let's find a policy that fits your budget. Request a free quote now.

This means the insurance company has to be extremely accurate to predict the future. With billions of dollars’ worth of insured property and only a 2% profit margin, insurers have to forecast with a high degree of certainty how much damage will occur in their portfolio in the upcoming year. They do this primarily through catastrophe modeling. This technique uses maps and past weather data to determine future risk. It is a detailed analysis of environmental conditions and the construction materials or project details that may be impacted by those conditions.

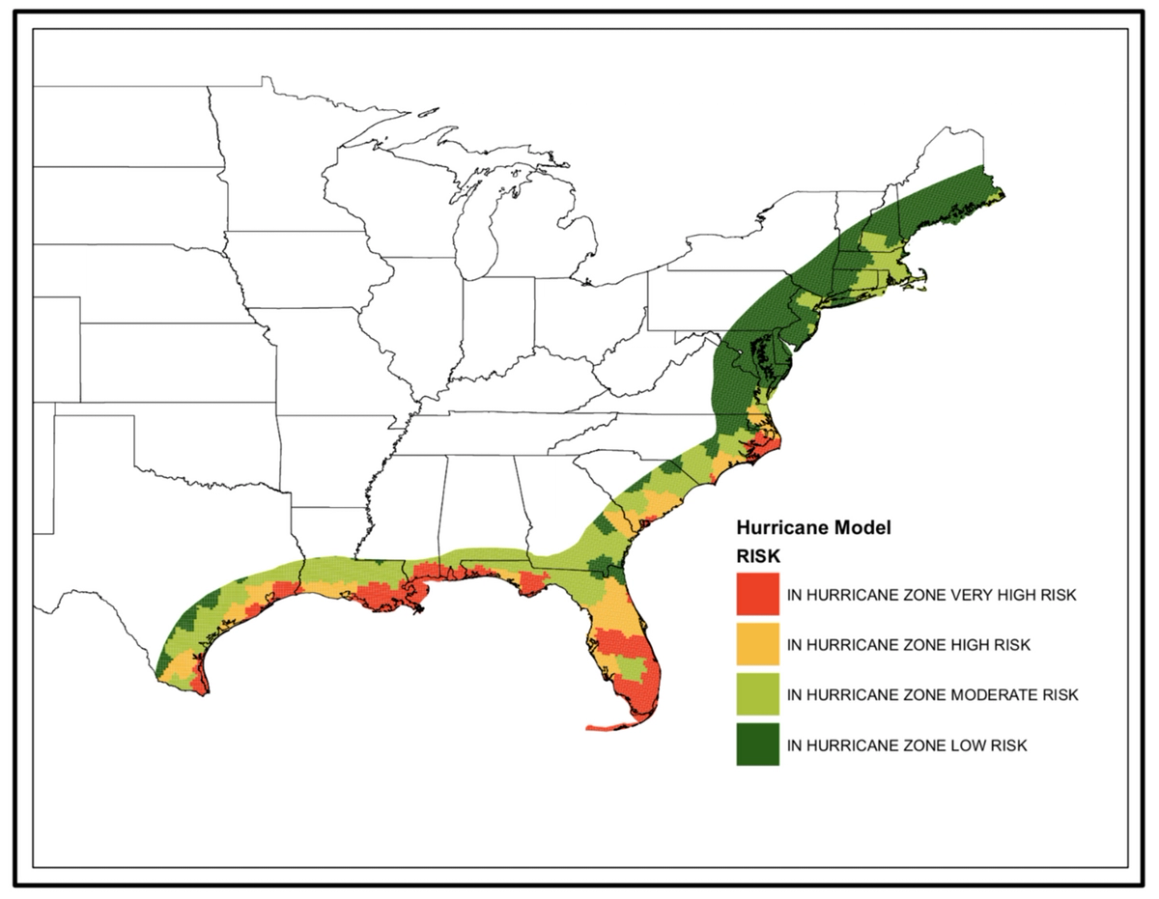

Take hurricanes, for example. Here's a simplified illustration of how insurance companies price the risk of a hurricane damaging your commercial building:

Source: Zywave

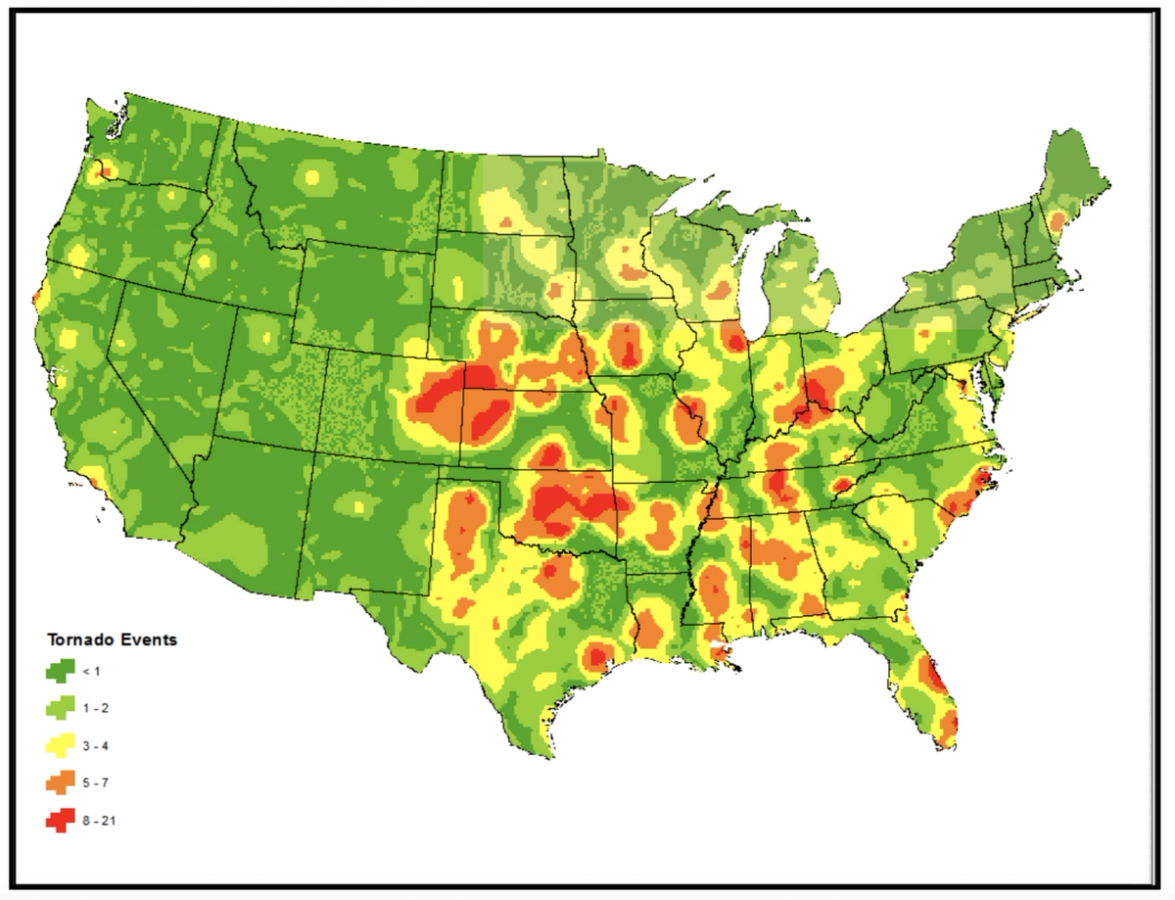

Additionally, here is an example model for how likely it is that an area will be damaged by a tornado.

Source: Zywave

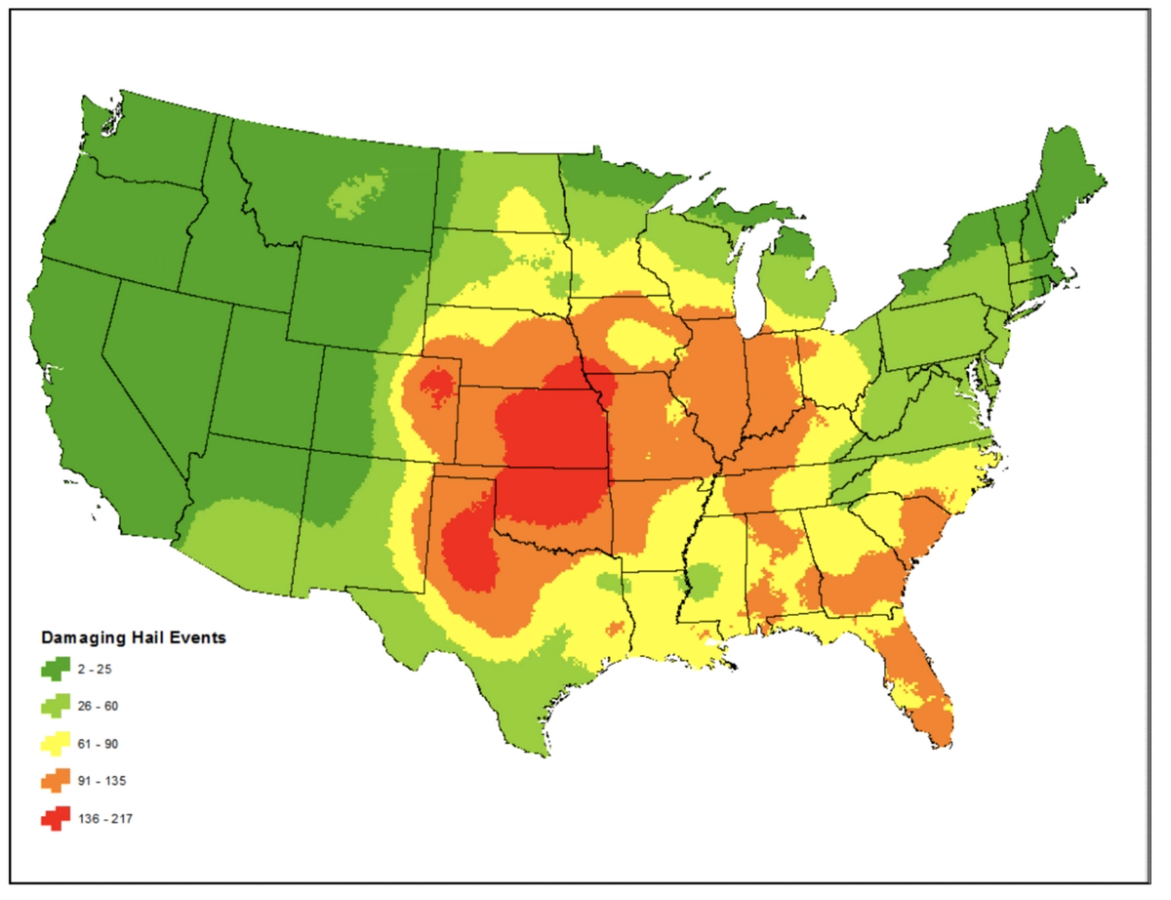

And lastly, here is the model example of how likely it is that your property will experience hail damage.

Source: Zywave

The list goes on and on, but you can start to see how insurance companies price for the actual risk of your property…and how important location can be in that pricing.

In addition to location, certain construction types are more durable to certain weather conditions, and thus cheaper to insure.

For example, if your property is in a high-wind area that’s prone to hail, insurers prefer to cover buildings with smaller, newer roofs made from more durable materials.

The same could be said for locations with a high risk of fire. If your property sits in an area with frequent wildfires, lightning, or dry conditions, insurers are going to cover metal buildings at a lower cost than wooden-frame buildings.

Additional Pricing Considerations

Fire Departments, Fire Alarms & Sprinkler Systems

It’s no secret that fire damage is one of the costliest insurance claims (and one of the primary reasons commercial property insurance exists!).

In addition to looking at your geographic location and weather patterns, the insurance company will calculate the distance between your property and the closest fire department, determine the fire department's quality, and measure the historical fire losses in your local area.

Additionally, when determining your rates, the insurance company will also consider any fire protection devices in your building, such as central station alarms and sprinkler systems.

The better your building’s profile, the lower your premiums.

Crime Scores

When determining the premium to charge for your commercial building, the insurance company will also score the crime in your area. Since insurance covers perils such as vandalism, theft, and break-ins, these risks are priced according to actual crime data. Additionally, insurance companies will give discounts for certain protective devices, such as video cameras and central station burglar alarms.

Loss History

The number of claims you have filed with your current and past carriers (usually over the previous three to five years) can play a large part in how your commercial property insurance is quoted.

The amount of claims you have filed in the past is a good indicator of the number of claims the insurance carrier can expect in the future. It is also a good indicator of how resistant to damage your building is in certain conditions or natural disasters.

Average Costs Of Commercial Property Insurance

Unfortunately, there are no average metrics to definitively determine your commercial property insurance rates. The difference in premium between a mild weather state versus a severe weather state can be greater than 10 times the price, and even factors such as the building’s occupancy can double the premium.

The best way to estimate how much you can expect to pay for insurance is to talk with an insurance broker and get a commercial property insurance quote. Even if the quote isn't "bindable" (meaning, with underwriting approval), you can often get an idea of what to expect if you are trying to plan ahead and budget.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.